BizBooks Solutions is a Canadian based outsourcing company and also having its intercompany in India. It is your one-stop-shop in the area of Accounting, Bookkeeping, Payroll & Taxation with established clientele In Canada, USA and other countries. We are passionate about providing high-quality support and solutions to our clientele at reasonable costs. We seek to build strategic partnerships with our clients to help them maximize their profitability and productivity in the most cost-efficient manner. BizBooks Solutions team comes with international experience in accounting, bookkeeping, payroll, taxation and other supporting services. BizBooks Solutions team is highly qualified and holds degrees like CPAs, CA, CA Inter, bachelors and masters in accounting.

Our mission is to help you grow your business with smart and flexible offshoring solutions with ‘Quality is Priority’ as an ultimate aspiration

Our vision is to become the recognized leader for outsourcing and offshoring solutions in the world.

Our values form the foundation for how we serve our clients. We value integrity, transparency, value creation, professionalism, social responsibility and family.

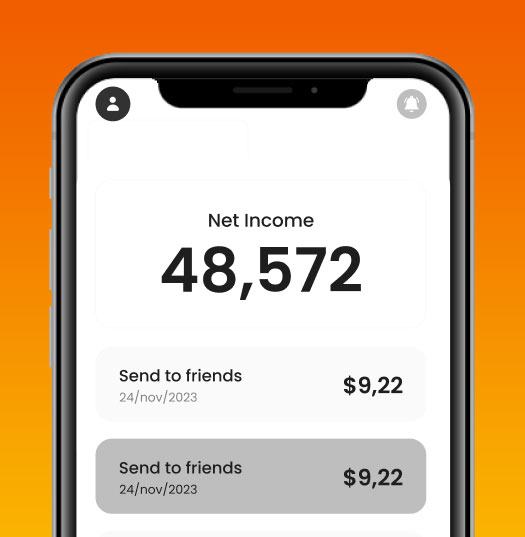

active user

Our accounting services cover the complete transition to new accounting software, including the setup of essential lists such as customers, vendors, employees, and inventory, along with configuring the chart of accounts and recording transactions. We handle the daily recording of financial transactions and ensure the monthly accrual of recurring expenses and utilities. Period-end adjustments and month-end closing schedules are carefully maintained to ensure accurate financial reporting. Our team conducts monthly reviews of select balance sheet accounts and generates comprehensive financial reports for both period-end and year-end analysis. Additionally, we manage the preparation and filing of GST, HST, and PST taxes, ensuring compliance with Canadian tax regulations. Our services also extend to personal and corporate tax filing, ensuring that all tax obligations are met efficiently and accurately.

Setting up customers in the accounting system requires proper documentation to ensure accuracy and compliance with financial regulations. This process includes gathering necessary details, verifying information, and maintaining organized records. Once customers are set up, sales orders are created, followed by the generation of sales invoices to document transactions accurately. Customer receipts processing and cash application services ensure timely posting of payments, reducing discrepancies and maintaining up-to-date records. Additionally, aging of receivables and receivables tracking help monitor outstanding balances, facilitating effective collection support. Coordinating with customers and resolving queries efficiently ensures smooth communication and enhances customer relationships. Lastly, all tax-related processes, including compliance and reporting, are handled in accordance with Canadian tax regulations to ensure accuracy and adherence to legal requirements.

lorem ipsum

Setting up vendors in the accounting system requires proper documentation to ensure compliance and accuracy. This includes collecting necessary details such as tax identification numbers, banking information, and contact details. Once vendors are established, purchase orders are created to authorize and track expenditures. The entry of invoices follows, ensuring that all received goods and services are accurately recorded in the system. Disbursement processing involves entering checks, ACH transactions, and fund transfers, ensuring timely payments to vendors. Regular accounts payable reports, including aging reports, help monitor outstanding balances and maintain cash flow efficiency. Effective vendor coordination and query resolution are crucial in maintaining good supplier relationships and ensuring smooth operations. Additionally, all tax-related matters, including compliance and remittances, are managed in accordance with Canadian tax regulations.

lorem ipsum

The responsibilities include setting up new hires and updating any changes for existing employees, ensuring accurate records are maintained. Payroll processing is conducted based on submitted timesheets, followed by the generation of accounting entries and pay stubs. Additionally, tasks involve preparing and submitting WCB returns, handling year-end tax slips such as T4, T5, and TA/T5018, and ensuring compliance with all Canadian tax regulations.

lorem ipsum

We specialize in comprehensive financial reconciliations, including bank account reconciliations, credit card reconciliations, and inter-company reconciliations to ensure accuracy and consistency in financial records. Our expertise also extends to accounts receivable (AR) and accounts payable (AP) reconciliations, helping businesses maintain a clear and transparent cash flow. Additionally, we handle loan and lease reconciliations to keep track of financial obligations efficiently. When it comes to taxes, we manage all tax-related matters exclusively within Canada, ensuring compliance with local regulations and optimizing tax processes for businesses.

lorem ipsum

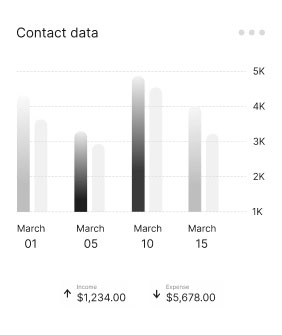

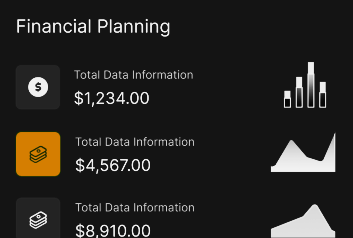

Our financial services encompass a comprehensive range of reporting and analysis to ensure accurate and efficient financial management. We provide detailed **balance sheets**, giving a clear snapshot of assets, liabilities, and equity. Our income statements help track revenue and expenses, allowing businesses to assess profitability. We also generate cash flow statements, ensuring transparency in financial inflows and outflows. Our inventory reporting helps businesses monitor stock levels and manage costs effectively. Additionally, we conduct monthly financial analysis of income statements, offering insights into trends and performance. Our expense reports provide a breakdown of costs, aiding in budgeting and cost control. We also offer custom reporting tailored to specific business needs. Lastly, we handle taxes, ensuring full compliance with Canadian tax regulations. Our goal is to deliver precise and actionable financial insights to support informed decision-making.

lorem ipsum

Our expert financial services are tailored to meet your unique needs, providing guidance and strategies for informed decision-making and growth.

With accurate accounting and strategic financial guidance, you can focus on scaling your business while we handle the numbers.

1. Client scan and upload files to a secure FTP server or shared drive service like dropbox

2. Processing of saved data saved. Update books and other files as per client preferences

3. Output files and final books uploaded to server, client download directly from server.

1. Client upload data to our secure FTP server

2. Work Distribution

3. Process Associate will do the work & Transfer to quality Manager

4. Quality checking and Final review of the work by process Manager

1. Clients place document/files in their computer

2. We access your computer with secure VPN and update the books.

3. Clients access the updated books in their computer

1. Client scan and upload files to online bookkeeping software

2. We update the books in online software as per uploaded files

3. Client access the updated books in online software

Our team of experienced professionals delivers personalized, results-driven financial strategies tailored to your unique goals. We prioritize transparency, trust, and long-term success.

We believe that a successful financial journey starts with understanding your unique needs and aspirations Our approach is built on a foundation of collaboration, transparency, and expertise.

Managing Director

Managing Director

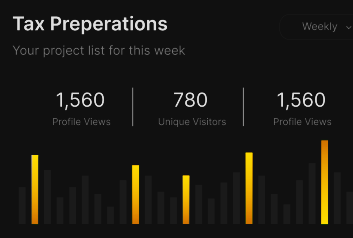

Explore fun and surprising facts about the financial world. Learn how history, trends, and innovations have shaped today's finance landscape, making it easier to navigate your financial journey.

Crafting tailored strategies to align with individual financial objectives.

Professional oversight to optimize investment portfolios for growth and risk mitigation.

Guidance on property investments for income generation and capital appreciation.

Discover our competitive pricing structure designed to provide accessible financial services without compromising quality. Empower your financial future today.

Hourly based Pricing

Hourly based Pricing

Hourly based Pricing

Fixed Pricing

Fixed Pricing

Fixed Pricing

Start your journey toward financial success with expert guidance and personalized solutions. Secure your future with confidence.

The first credit card ever issued was made of cardboard and was introduced.

we believe that you should keep more of what you earn.

To create a business budget, start by estimating your income and listing all fixed and variable expenses. Subtract expenses from income.

Cash flow refers to the movement of money in and out of your business. Positive cash flow ensures you can cover operational costs.

Build financial stability by maintaining a strong cash reserve, cutting unnecessary costs, managing debt carefully.

Key financial metrics include net profit margin, cash flow, operating expenses, debt-to-equity ratio, and return on investment (ROI).

You should review your budget monthly or quarterly to ensure you're on track with projections. Regular reviews help.

FinTech solutions can streamline financial operations through automation, improve data accuracy, enhance decision-making.

+91 6280003434

+91 7087078086

info@bizbookssolutions.com

3rd floor, D-234 (Blue Saphhire), Phase 8B, Industrial Area, Sector 74, Sahibzada Ajit Singh Nagar, Punjab 160071